Deep Dive: Global Remittances 💸💸

[Issue #7] In our first of many upcoming deep dives, we will look at global remittances and realize how much of today's world is interdependent! Let's dive in...

Reading time: About 4 minutes

Why this topic?

I am an expat from India living in France for more than two years now! Back in India, I was completely unaware about remittances as it did not affect my life. In fact until 3 years ago, I did not even know about the term “Remittance”!

Now that I am in France, I remit money almost every month. I was intrigued to learn about how big the flow of money is and between which countries?

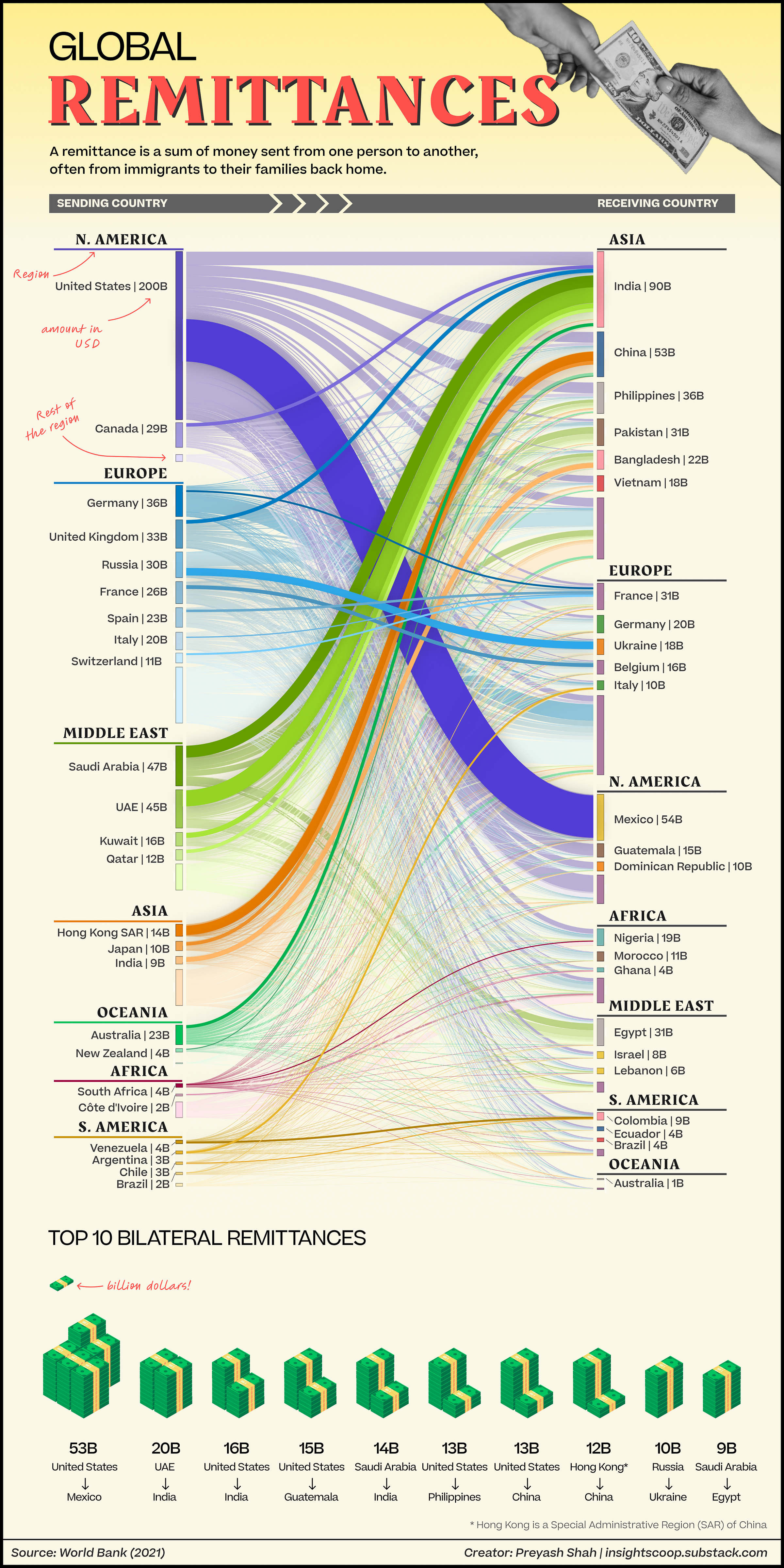

I could have guessed that India would be the largest recipient of remittances and the US would be the largest sender, but I was surprised to learn that the US → Mexico bilateral remittance is the highest in the world, more than twice the size of the second highest pair. 🤯.

With that, let’s check out the visualization for our this week’s deep dive —

Global Remittance Market

The global remittance market is a large and growing market, with remittances reaching $770+ billion in 2021, according to Allied Market Research.

Remittances are an important source of income for developing countries, accounting for an average of 5% of their GDP. They help to reduce poverty, improve living standards, and support economic growth. Remittances are also used to invest in education, healthcare, and housing.

The global remittance market is expected to continue to grow in the coming years, driven by factors such as increasing migration, rising incomes in developing countries, and the adoption of digital remittance channels.

Major Trends

Remittance flows to low- and middle-income countries (LMICs) are expected to grow by 1.4% to $656 billion in 2023, a slowdown from the 8% growth seen in 2022. This is due to softer economic activity in remittance source countries, which is limiting employment and wage gains for migrants.

Remittances have become increasingly important for LMICs during the post-COVID period of slower economic growth and falling foreign direct investments.

The top five recipient countries for remittances in 2022 were India, Mexico, China, the Philippines, and Pakistan.

Remittance inflows represent large shares of GDP in some countries, such as Tonga (49.9%), Lebanon (37.8%), Samoa (33.7%), Tajikistan (32%) and the Kyrgyz Republic (31.2%).

The average cost of sending $200 was 6.2% in the fourth quarter of 2022, up slightly from 6% a year ago, and more than twice the Sustainable Development Goal target of 3%.

Regional Trends

East Asia and the Pacific: Remittances increased by 0.7% to reach $130 billion in 2022. Remittances to China have been on the decline, but remittances to other countries in the region were supported by strong demand for high-skilled migrants in OECD countries and continued demand for workers in the GCC countries.

Europe and Central Asia: Remittance flows grew 19% to a record high of $79 billion in 2022, mainly due to record high amounts of money transfers from the Russian Federation to neighboring countries. In 2023, remittance flows to the region are projected to grow by 1%.

Latin America and the Caribbean: Remittances increased by 11.3% to $145 billion in 2022, aided by the strong U.S. labor market. In 2023, remittances are projected to grow by 3.3%, but the risks are skewed to the downside due to the slowing U.S. economy.

Middle East and North Africa: Growth in remittances fell by 3.8% to $64 billion in 2022. In 2023, remittance inflows are projected to grow by 1.7%.

South Asia: Remittances grew by over 12% in 2022 to $176 billion. In 2023, remittances are projected to grow by 0.3% due to slower growth in the OECD economies and migrants’ preference for informal relative to formal channels of money transfer in some countries.

Sub-Saharan Africa: Remittance flows grew by 6.1% in 2022 to $53 billion. In 2023, growth in remittances is expected to ease to 1.3%.

Evolution of remittance market

Here are some of the trends that are shaping the global remittance market:

The rise of digital remittances: Digital remittances are expected to grow rapidly in the coming years, with the total volume of transactions exceeding 2 billion globally by 2027. This growth will be driven by the increasing speed and low cost of digital remittances versus traditional agent-based services.

The growth of fintech remittances: Fintech companies are playing an increasingly important role in the remittance market. Fintech companies are able to offer lower fees and faster transfer times than traditional remittance providers.

The increasing use of mobile remittances: Mobile remittances are becoming increasingly popular, as they allow migrants to send money to their families back home using their smartphones. Mobile remittances will account for over 73% of all digital remittances globally by 2027.

Sources:

World Bank Report [PDF]

Defying Predictions, Remittance Flows Remain Strong During COVID-19 Crisis

Financial remittances and official development assistance, World Bank

World Bank says remittances up 5% in 2022, but growth to slow to 2% next year - Reuters

… and that’s our Insight Scoop for this week!

If you found some value from this post, then please forward it with your friends, family and network :)